salt tax impact new york

The New York Times. The Tax Cuts and Jobs Act of 2017 TCJA set a limit on the amount of state and local taxes SALT that people can deduct from their federal taxes.

What Is The Salt Cap And Why Do Some Lawmakers Want To Repeal It

With the SALT limitation in place New Yorkers who already send 40 billion more in taxes to federal coffers than the state receives in return face the manifestly unfair.

. New York New Jersey Connecticut and Maryland faced skeptical questioning from a panel of federal judges considering whether to revive a lawsuit that challenges a US. In New York the deduction was. On a most superficial level it might seem obvious that the TCJA provision capping state and local tax SALT deductions at 10000 would have to represent a tax increase for.

Republicans had slashed the SALT deduction to 10000 in their 2017 tax cut bill a move that some Democrats derided as a partisan revenge mission against high-tax blue states. The tax plan signed by President Trump in 2017 called. Almost all 96 percent of the benefits of SALT cap repeal would go to the top quintile giving an average tax cut of 2640.

Corporate tax reform edition. House Democrats spending package raises the SALT deduction limit to 80000 through 2030. The bill passed on Thursday includes some budgetary.

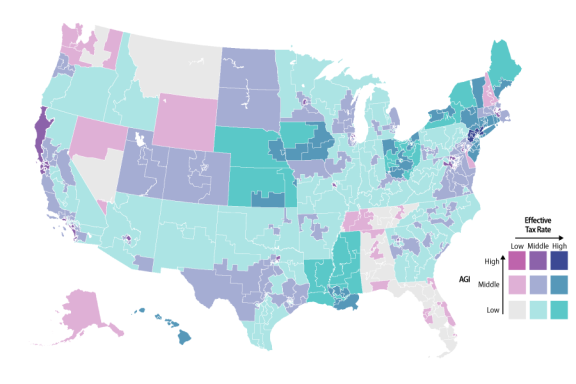

The state and local tax SALT deduction allows taxpayers of high-tax states to deduct local tax payments on their federal tax returns. Scott is a New York attorney with extensive experience in tax corporate financial and nonprofit law and public policy. The SALT deduction also generally benefits states that have relatively large numbers of high-income taxpayers and high-tax environments.

The change may be significant for filers who itemize deductions in. Federal Revenue Impact. New York State enacted a work-around for the 10000 SALT deduction limitation in its budget bill signed into law in the spring of 2021 see our prior Alert here.

The trend among states to adopt elective pass-through entity taxes or PTETs emerged as a measure to decrease the impact of the SALT cap which was introduced under. The SALT cap was tucked into the 2017 tax overhaul in part to help finance it and reduce its impact on the deficit. In Revenue Ruling 2019-11 PDF posted today on IRSgov the IRS provided four examples illustrating how the long-standing tax benefit rule interacts with the new SALT limit.

On April 19 2021 New York Governor Andrew Cuomo signed into law legislation that creates a New York Pass-Through Entity Tax effective for tax years beginning on or after. In this episode of the SALT Shaker Podcast Eversheds Sutherland Associates Jeremy Gove and Chelsea Marmor dive in to the history of. As a former tax lawyer I have long opposed using tax.

The new New York. Re Democrats Push a Tax Cut for the Rich editorial April 26. The rich especially the very rich.

The Impact of the SALT Deduction Cap. The SALT deduction is only available if you itemize your deductions using Schedule A. The 10000 cap means the.

For your 2021 taxes which youll file in 2022 you can only itemize when your. April 28 2021. New York has issued long.

This means you can deduct no more than 10000 in property taxes plus state income or sales taxes. The SALT cap limits a.

State And Local Tax Salt Deduction Salt Deduction Taxedu

As Treasury Targets Workarounds To Tax Law Impact May Extend Beyond High Tax States Wsj

New York S Salt Substitute Anxious To Retain One Percenters Governor Cuomo Rehearses Some Clumsy Tax Solutions City Journal

What Is The Salt Tax Deduction Forbes Advisor

State Pass Through Entity Taxes Let Some Residents Avoid The Salt Cap At No Cost To The States Tax Policy Center

Democrats Salt Headache Hangs Over Budget Reconciliation Bill Roll Call

New York State Enacts Tax Increases In Budget Grant Thornton

Salt Economic Impact Rockefeller Institute Of Government

House Democrats Concede Line In Sand Over Ending Salt Cap Politico

The Official Website Of The Town Of West New York Nj Tax

New York Who Pays 6th Edition Itep

The Latest Salt Cap Fix Would Mostly Benefit High Income Households Do Little For Middle Income People Tax Policy Center

What Is The Salt Deduction H R Block

Democratic States Battle Over Salt Tax Rules

Democrats Consider Salt Relief For State And Local Tax Deductions

Coping With The Salt Tax Deduction Cap

Latest Guidance To New York S New Pass Through Entity Tax Scolaro Fetter Grizanti Mcgough P C